|

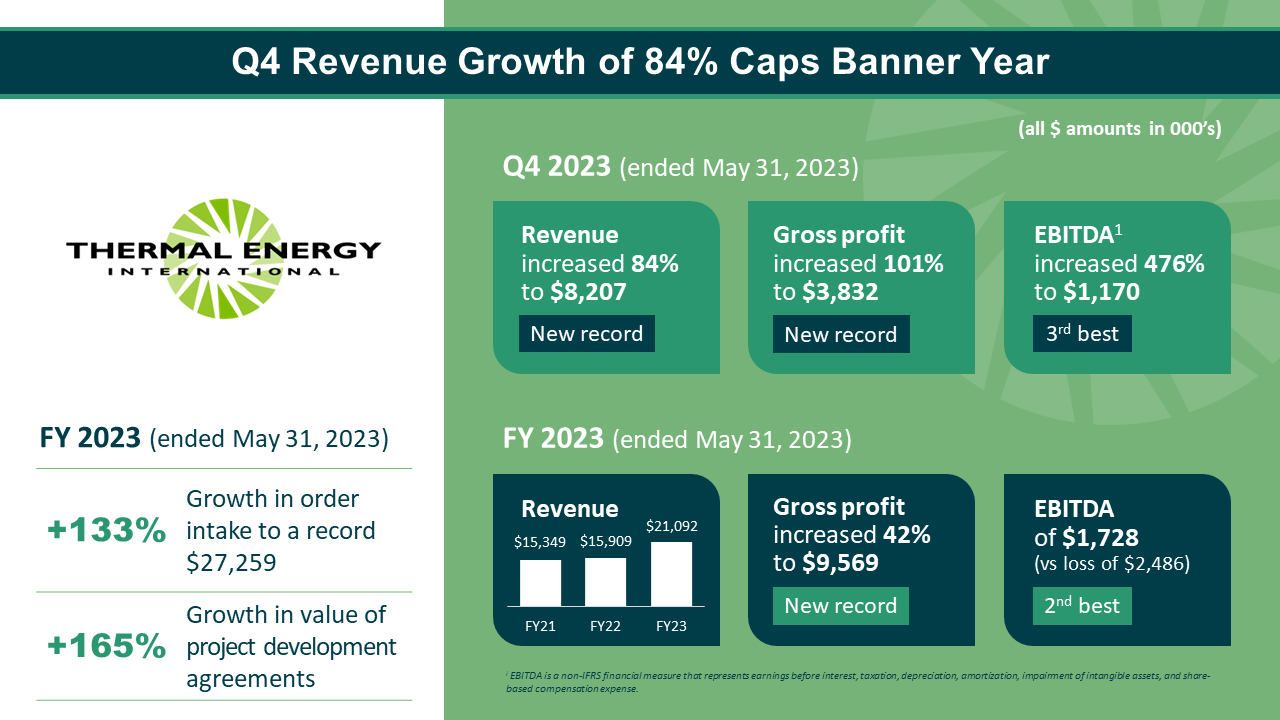

Company’s order intake up 130% in fiscal 2023 Thermal Energy International Inc. (“Thermal Energy” or the “Company”) (TSX-V: TMG, OTCQB: TMGEF), a provider of innovative energy efficiency and carbon emission reduction solutions to major corporations around the world, today reported its financial results today for the fourth quarter and year ended May 31, 2023. All figures are in Canadian dollars. “The fourth quarter was one of our best quarters ever, setting new records for revenue and gross profit, and was a great finish to an excellent year,” said William Crossland, Thermal Energy CEO. “For the fiscal year, we had record gross profit and our second highest annual revenue and EBITDA. We saw a return in demand for our turn-key solutions, adding to the already strong growth we had in Custom Equipment. Additionally, our order intake and number of signed project development agreements in fiscal 2023 were higher than ever.” “We continue to see strong interest from companies looking to save money while reducing their carbon emissions. Since the end of our fiscal year, we’ve received $8.4 million in new orders, including a $4 million order from a multinational pharmaceutical company – our largest turn-key order since before the pandemic. Additionally, we have several active project development agreements that we expect to convert into orders, and we have a robust and growing business development pipeline, positioning us well for a solid fiscal 2024.” Fourth Quarter and Fiscal 2023 Financial Review

Fourth quarter revenue was $8.2 million, up 84% from the same quarter the year before. The growth was mainly due to the higher revenues from both Custom Equipment and Turn-key Heat Recovery Projects due to the increase in sales orders received in fiscal year 2023. Gross profit increased 101% to a quarterly record of $3.8 million, due to the growth in revenues. Operating expenses were $845 thousand more than the same quarter last year mainly due to staff's salary and incentive increase, change in foreign exchange gains and reduction in government subsidies received as compared to the last quarter of fiscal year 2022. Expenses are also up due to a number of growth-oriented investments being made such as additional project engineers, sales staff in new markets and a significant investment in the digitalization and automation of the key business processes, all of which are designed to increase efficiency, profitability and top line growth. Nonetheless, as a result of the increased revenues and gross profit, the net income and EBITDA for the quarter were $1.1 million and $967 thousand better than the fourth quarter last year, respectively. For the year ended May 31, 2023, revenue was $21.1 million, up 33% from last year. The increase in revenues was mainly due to increased sales orders received in fiscal year 2023. Gross profit for the year was $9.6 million, an increase of $2.8 million, or 42%, mainly due to the increased revenue from GEM. Operating expenses incurred for the year amounted to $8.3 million, $140 thousand more than last year mainly because of increased staff costs, investment in digitalization, less government subsidies received, offset by the reduction in acquisition costs in the amount of $188 thousand, and the increase in foreign exchange gains of $84 thousand. As a result, the Company achieved net income of $720 thousand and EBITDA of $1.7 million, both representing an increase of $2.5 million from the prior year. Business Outlook and Order Summary Orders received (“Order Intake”) during the year totalled $27.3 million, an increase of 130% compared to $11.8 million in the prior year and the highest 12-month order intake in the Company’s history. As a result, the Company ended the year with an order backlog of $13 million, up 166% from the $4.9 million at the end of the prior year. The Company has received $8.4 million in new orders subsequent to the May 31, 2023, year-end, bringing the current order backlog to $21.4 million as of September 26, 2023. A list and description of recent order highlights is available on page 15 of the Management’s Discussion and Analysis filed today. About Thermal Energy International Inc. Thermal Energy International Inc. provides energy efficiency and emissions reduction solutions to Fortune 500 and other large multinational companies. We save our customers money by reducing their fuel use and cutting their carbon emissions. Thermal Energy’s proprietary and proven solutions can recover up to 80% of energy lost in typical boiler plant and steam system operations while delivering a high return on investment with a short, compelling payback. Thermal Energy’s common shares are traded on the TSX Venture Exchange (TSX-V) under the symbol TMG and on the OTCQB under the symbol TMGEF. For more information, visit the Company's investor website at https://investors-thermalenergy.com. Source: Thermal Energy International

0 Comments

Leave a Reply. |

Follow @SharePitch on TwitterArchives

May 2024

Categories |

RSS Feed

RSS Feed