|

Sharp uptick in order intake subsequent to quarter end Thermal Energy International Inc. (TSXV: TMG) (OTCQB: TMGEF) ("Thermal Energy" or the "Company"), a provider of innovative energy efficiency and carbon emission reduction solutions to major corporations around the world, today reported its financial results for the first quarter ended August 31, 2023. All figures are in Canadian dollars. Highlights:

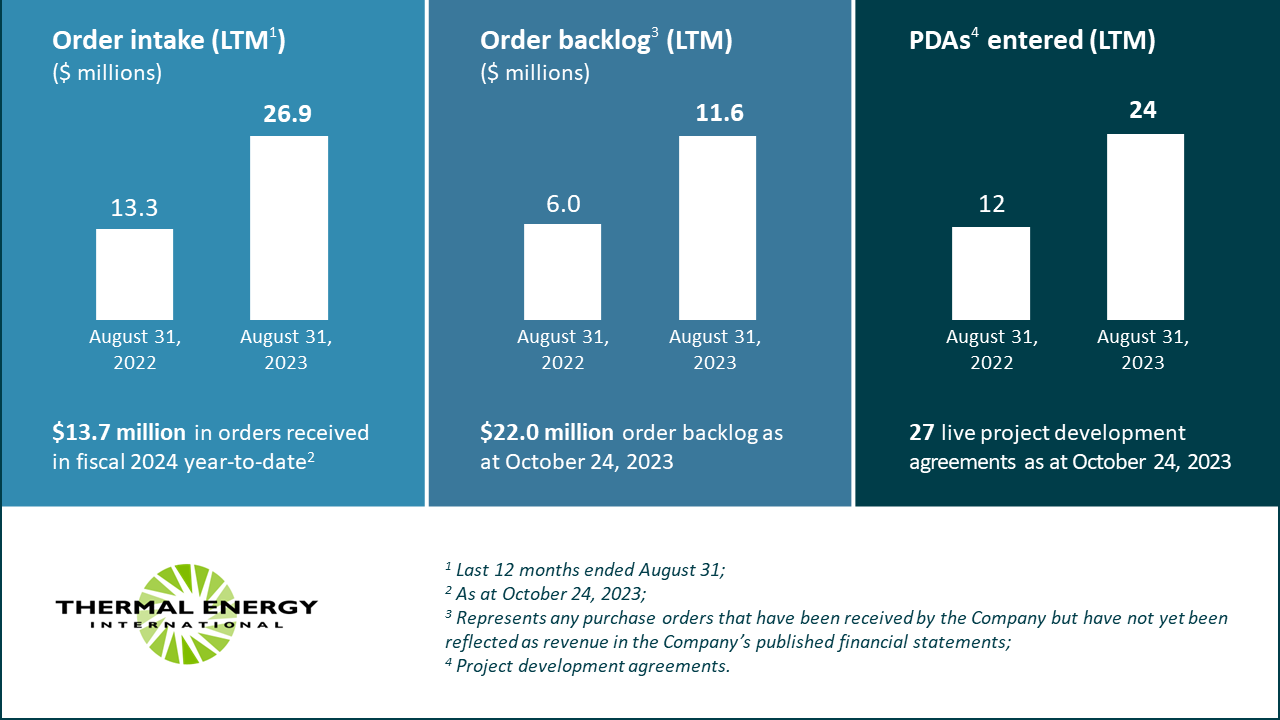

"We are proud of the substantial growth in our revenue and gross profit during the quarter, as well as the strong turnaround in our bottom line compared to a year ago," said William Crossland, Thermal Energy CEO. "Subsequent to quarter end, we received our largest heat recovery order in several years - and our first turn-key heat recovery order from a pharmaceutical company. We also signed a Global Master Services Agreement with this customer and already have paid project development agreements ("PDA") for two other sites active with them. Earlier this month, we received $1.9 million in repeat business from a global nutrition company and $2.6 million in repeat business from a multinational dairy company." "Following our record order intake in fiscal 2023, we have already received orders totalling over $13.7 million just five months into fiscal 2024. Our order backlog is currently $22.0 million, and we have 27 active PDAs in place. Our strong order intake, order backlog, and project development activity are clear indications of the strong demand for our proven energy efficiency solutions as our global customer base actively pursues their carbon emissions reduction targets." First Quarter 2024 Financial Review

First quarter revenue was $5.2 million, up 66% from the same quarter the year before. The growth was mainly due to the higher revenues from both Custom Equipment and Turn-key Heat Recovery Projectsiii due to the increase in sales orders received in fiscal year 2023. Gross profit increased by 105% to $2.8 million, due to growth in revenues and improving margins across all key product categories. Operating expenses were $748 thousand more than the same quarter last year, with $338 thousand of the variance due to an increase in foreign exchange loss, and $410 thousand due to recruitment of additional project engineers, sales staff and investment in the digitalization and automation of the key business processes. Nonetheless, the higher revenues and gross profit led to increases of $670 thousand and $644 thousand for net income and EBITDA, respectively, compared to the first quarter of last year. Quarter end cash and working capital balances were around $4.1 million and $3.1 million, respectively. Business Outlook and Order Summary Orders received ("Order Intake") during the first quarter totalled $3.3 million. The Company ended the quarter with an order backlog of $11.6 million, up 93% from the $6.0 million at the end of the same quarter of prior year. The Company has also received $10.4 million in new orders subsequent to the August 31, 2023, quarter-end, bringing the current order backlog to $22.0 million as of October 24, 2023. A list and description of recent order highlights is available on page 13 of the Management's Discussion and Analysis filed today. Full financial results including Management's Discussion and Analysis and accompanying notes to the financial results are available on www.sedarplus.ca and investors-thermalenergy.com/en/financial-overview. About Thermal Energy International Inc. Thermal Energy International Inc. provides energy efficiency and emissions reduction solutions to Fortune 500 and other large multinational companies. We save our customers money by reducing their fuel use and cutting their carbon emissions. Thermal Energy's proprietary and proven solutions can recover up to 80% of energy lost in typical boiler plant and steam system operations while delivering a high return on investment with a short, compelling payback. Thermal Energy's common shares are traded on the TSX Venture Exchange (TSX-V) under the symbol TMG and on the OTCQB under the symbol TMGEF.

0 Comments

Leave a Reply. |

Follow @SharePitch on TwitterArchives

May 2024

Categories |

RSS Feed

RSS Feed